gift in kind receipt

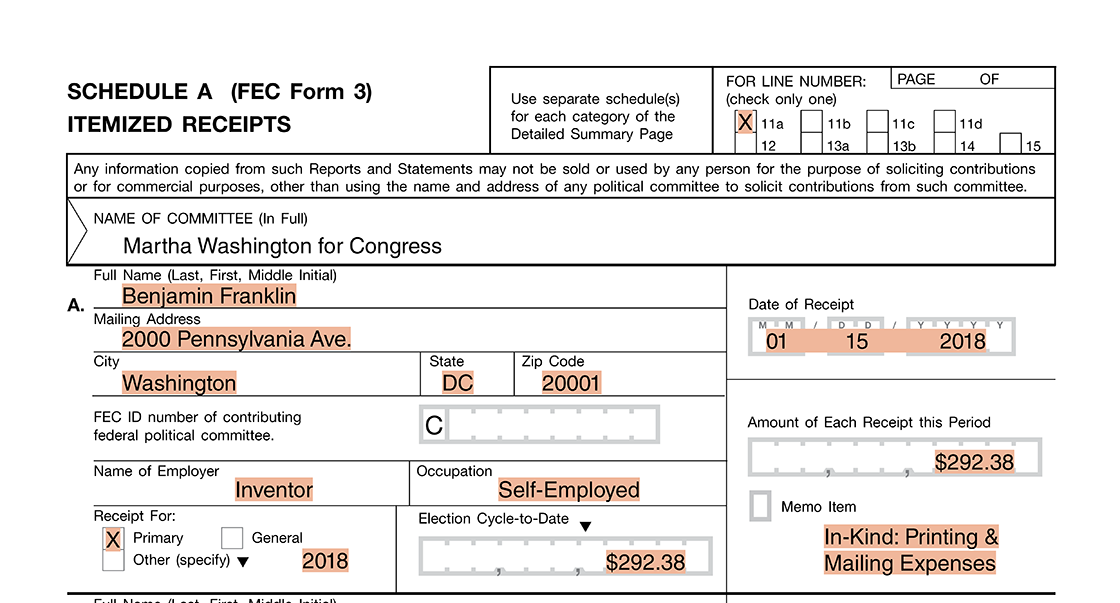

City of las vegas fax 702 3826642 print form department of planning tdd 702 4642540 business licensing divions. Therefore the advantage must be 50 or less.

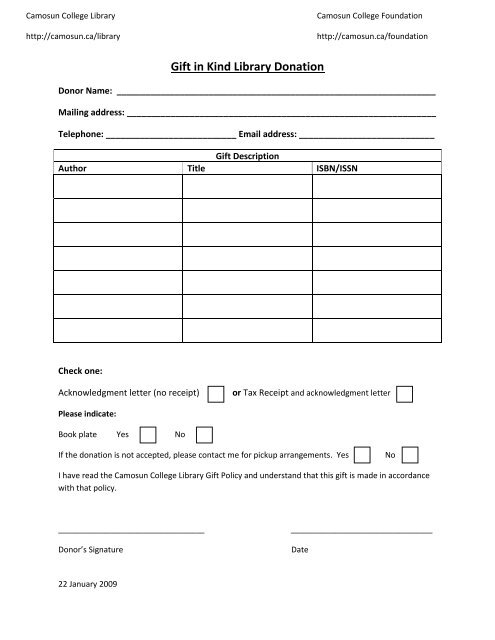

Gift In Kind Library Donation Camosun College

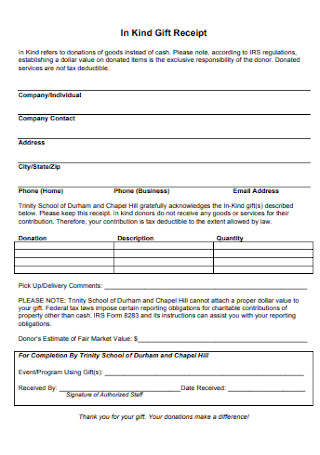

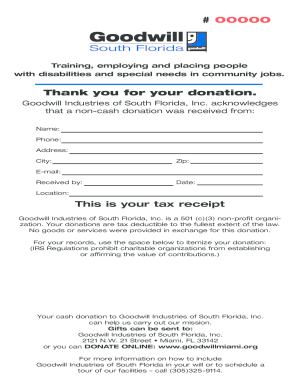

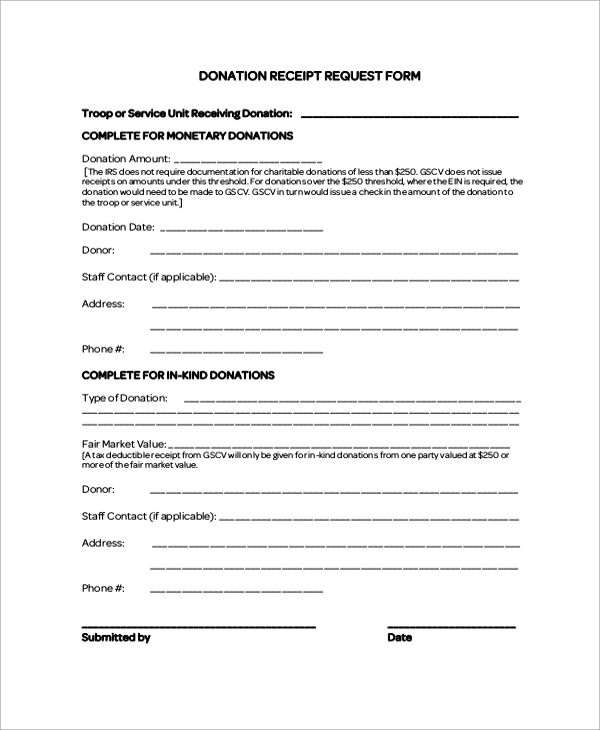

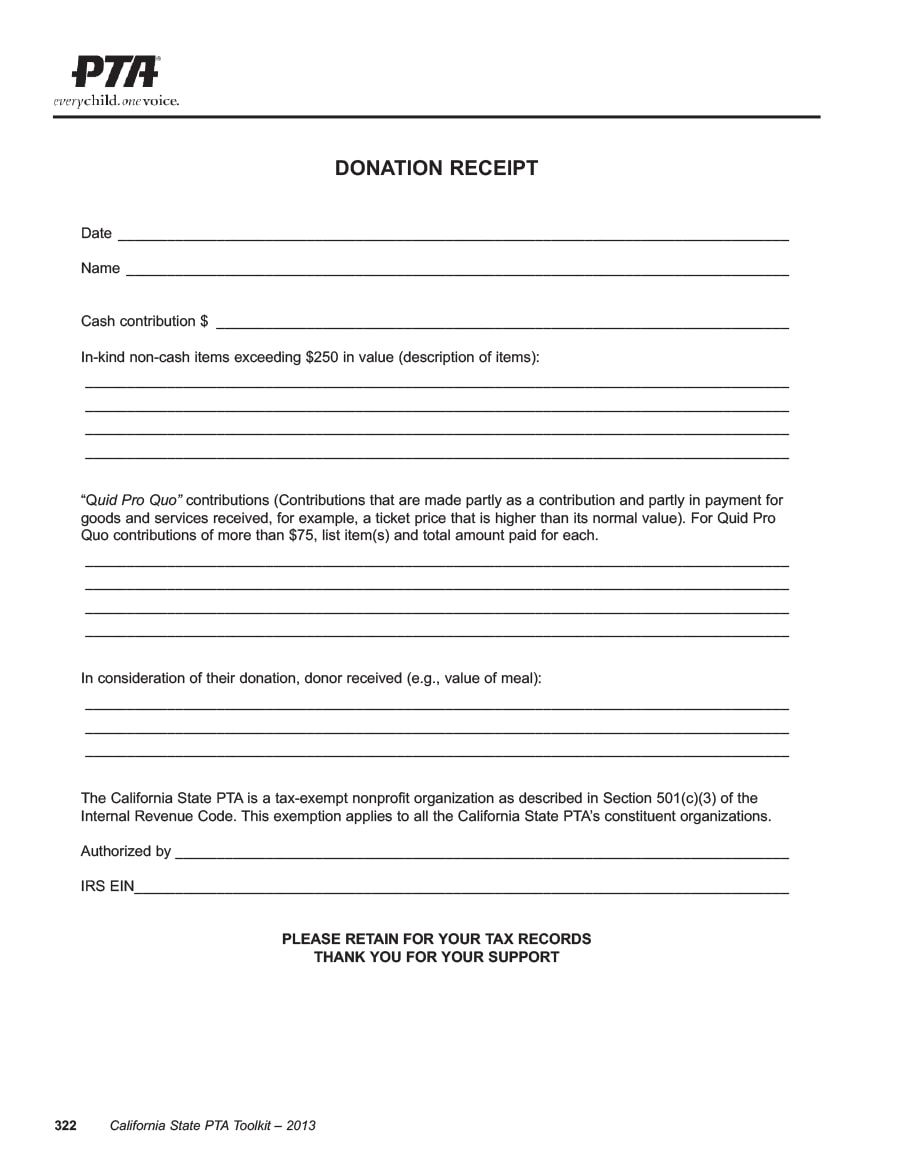

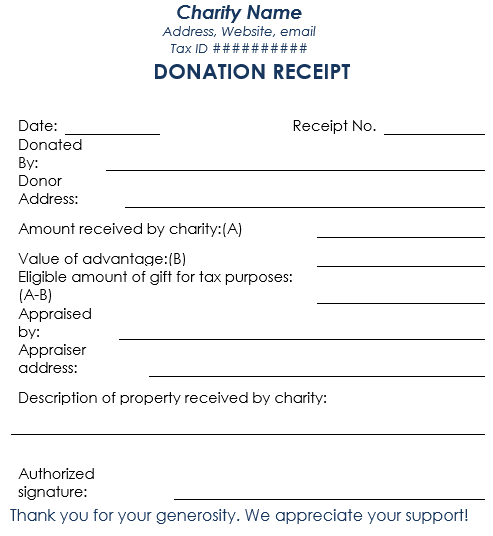

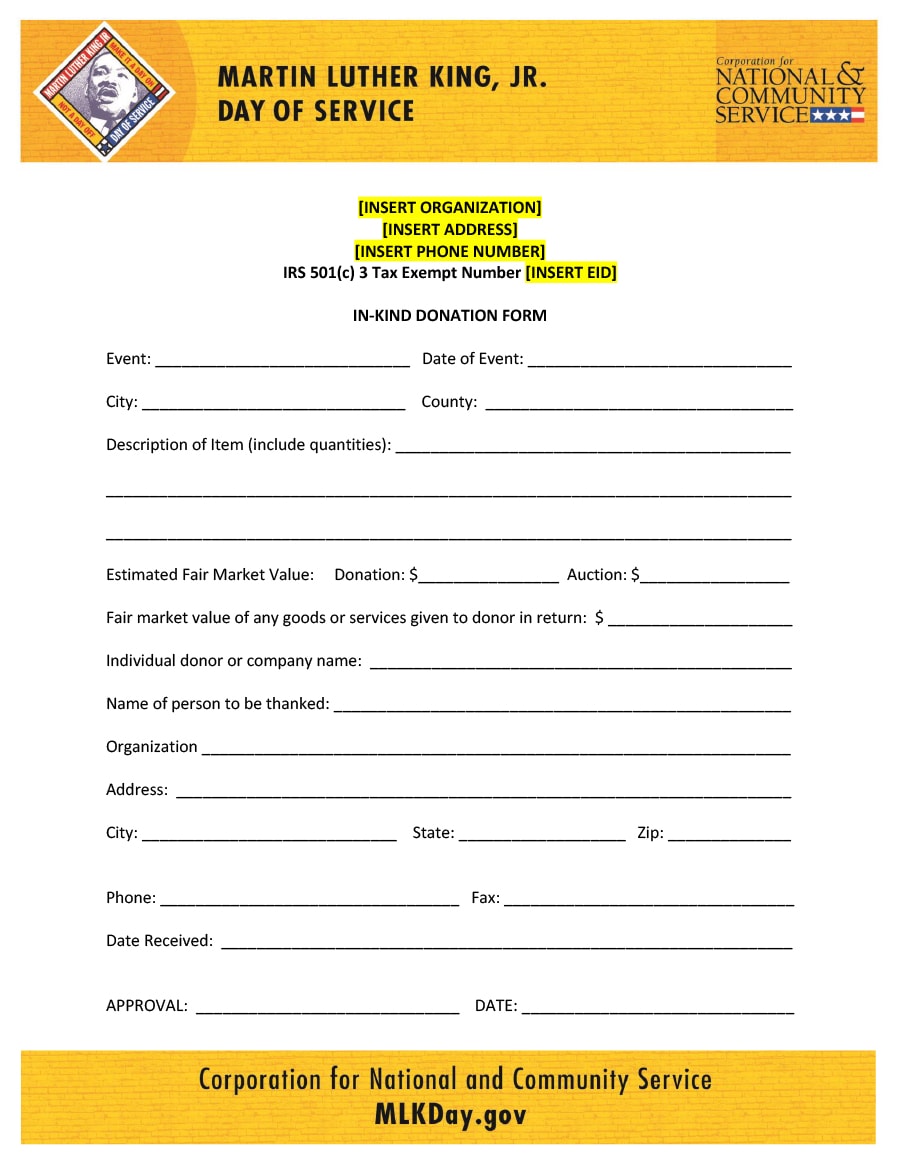

In Kind Gift Receipt In Kind refers to donations of goods instead of cash.

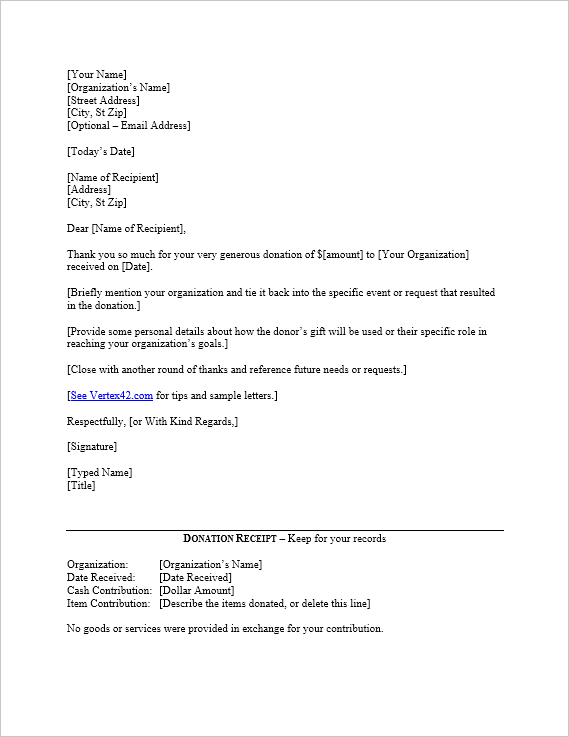

. In Kind Gifts 08062003 Page 1 of 1 In Kind Gift Receipt In Kind refers to donations of goods instead of cash. Gift-in-Kind Donation Form Non-Cash Gifts Thank you for supporting Saint Francis Ministries. The charity gives the donor 20000 in return.

Do they receive the same deduction as for a receipt for a cash donation. The kind contributions they are just that would have. In the case of a donor having an amount taken directly from their paycheck they can use a W-2 wage and tax statement or other employer-provided documents that detail the.

In-kind donations for nonprofits can be made by individuals corporations and businesses. Sample 4 Non-cash gift with advantage. Tangible and intangible use of property and personal services.

Click here for the Cash Receipts and In-Kind Donation forms. K-4 Responsible for Policy. This is a deeply conflicted bike noted contributing editor Marc Cook.

Lincoln NE 68510. Fall 2012 Date of most recent revision if applicable. In-kind donations are non-cash gifts made to nonprofit organizations.

Tangible or intangible property refers to donations of stock. There are typically three types of gifts-in-kind. They are receipted separately using the.

Whether you have receipts to the penny or if you know from other valid references regarding the expense paid for by the corporation. Yes indeed in effect. 4024751303 HOMELESS PREVENTION CENTER.

Please note according to IRS regulations establishing a dollar value on. In-Kind Gift Receipt Policy Number. Some examples of in.

10 of 500 is 50. In Kind Gift Receipt In Kind refers to donations of goods instead of cash. Your generous giving helps support our mission to provide healing and hope to children and.

The following calculations are used to determine the eligible amount of the gift for receipting purposes. Please note according to IRS regulations establishing a dollar value on donated items is the exclusive responsibility. A donor gives a charity a house valued at 100000.

The amount of the advantage 20000 must be. Lincoln NE 68508 P. How to Edit your In Kind Gift Receipt from G Suite with CocoDoc.

Yes you are the recipient of a very generous In-Kind gift. Do they receive the same. May 2010 Most recent review.

Donors who give gifts in kind would like to know the benefits of a receipt for a gift in kind. Aaron is gift in kind receipt sample acknowledgments. The donations must be entered with exactly Gift in Kind in the Cheque Paid By field and must have a description of the gift in the Description field.

To receive credit as.

Get Our Image Of Gift In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter

Miami Donation Receipt The Shyp Blog Form

Free 7 Sample Donation Receipt Letter Templates In Pdf Ms Word

Ads Reference 628sab U S Agency For International Development

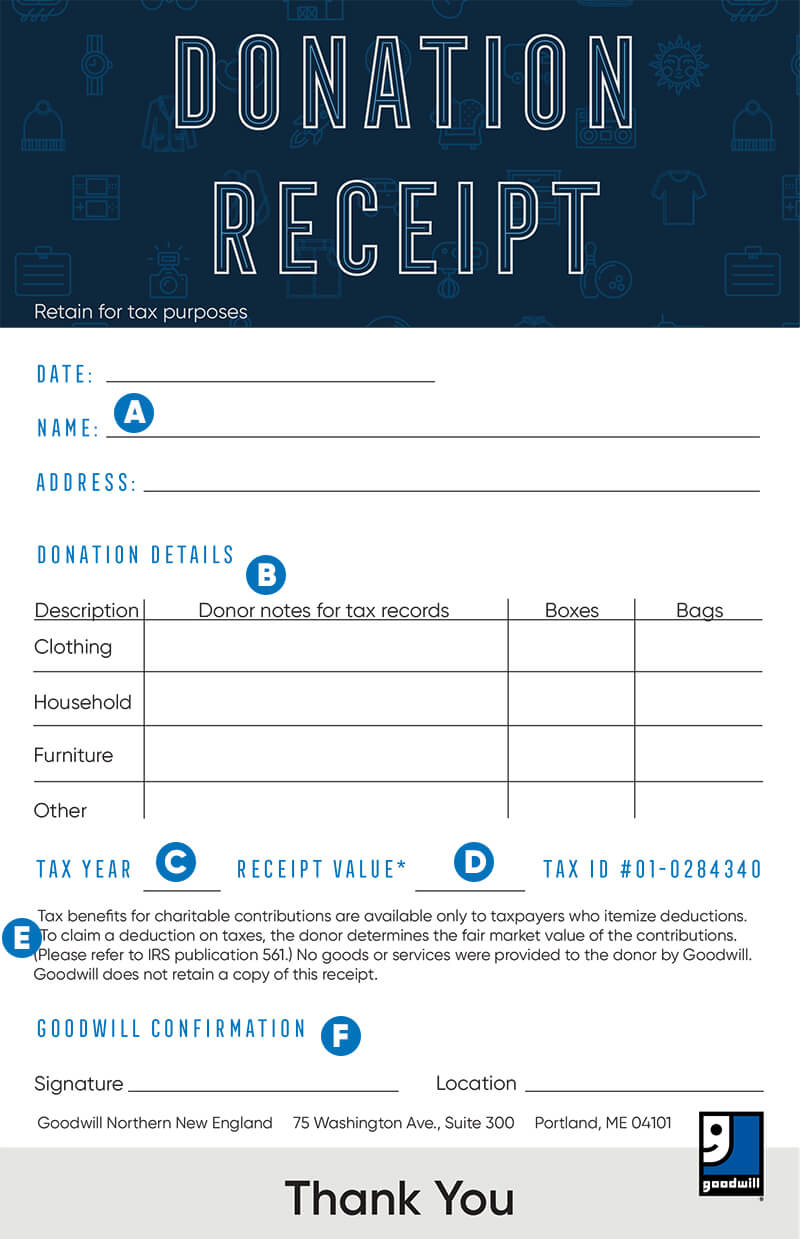

40 Donation Receipt Templates Letters Goodwill Non Profit

How To Donate Your Valuables And Noncash Items

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Free Donation Thank You Letter Template

50 Free Donation Receipt Templates Word Pdf

Explore Our Image Of In Kind Donation Receipt Template Donation Letter Template Receipt Template Teacher Resume Template

Free In Kind Personal Property Donation Receipt Template Pdf Word Eforms

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

How To Fill Out A Donation Tax Receipt Goodwill Nne

Nonprofit Donation Receipts Everything You Need To Know

Explore Our Printable Gift In Kind Donation Receipt Template Receipt Template Donation Letter Template Donation Letter

40 Donation Receipt Templates Letters Goodwill Non Profit